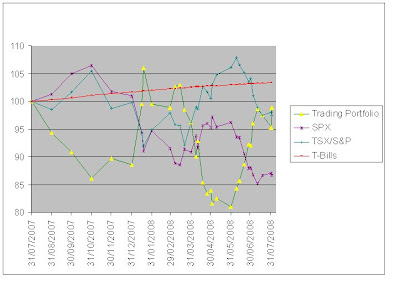

Performance in August was good. It was my third consecutive month of positive returns. I am trying to improve the consistency of my performance instead of always shooting for the moon. Moon shooting is great when it works out, but it can be nasty if you are wrong. My little bit of risk management earlier in the month helped out, as the TSX and gold both rose after that point. I am looking to off-load the gold on any strength. I was going to do it mid-week but, alas, I was not able to trade so missed the opportunity. So far the bounce has been tepid, but I expect at least a minor surge before it turns lower again.

Performance in August was good. It was my third consecutive month of positive returns. I am trying to improve the consistency of my performance instead of always shooting for the moon. Moon shooting is great when it works out, but it can be nasty if you are wrong. My little bit of risk management earlier in the month helped out, as the TSX and gold both rose after that point. I am looking to off-load the gold on any strength. I was going to do it mid-week but, alas, I was not able to trade so missed the opportunity. So far the bounce has been tepid, but I expect at least a minor surge before it turns lower again.As for the broader markets, they have been pretty directionless, as any look at a chart shows. The conditions seem to be building for another leg downwards. Sentiment had a boost with the revised US Q2 GDP numbers on Thursday. There seems to be a growing sense that the US may have dodged the recession bullet. Meanwhile, European and Asian data has been pretty bad, threatening the exports that have kept the US afloat. Mortgage rates are still high due to the problems at FNM and FRE, which should prevent the housing market from recovering quickly.

Some of my favourite indicators are starting to suggest an increase in financial stress. EUR/JPY is below 160, US 2 year treasury yields have fallen by 23 bps in the past month, and the CP discount rate has ticket up a bit. VIX is still low at about 20, however, indicating that the pressure has yet to have too much impact on equity markets (although european and asian indices were weakish this week).

From a psychological standpoint, the market may need to move sharply higher in the near term in order to increase the bulls confidence and shake out the weak bears. This would set-up a sharp decline over a few week period to much lower lows. This is a low conviction prediction, but if the market DOES move much higher over the near term I may increase short positions.

MARKET POSITION: EQUITIES - short SPX (5 units); short S&P/TSX (3 units); short EAFE (3.5 units); short energy (2 units); short real estate (2 units) ; long gold (2 units)