...I became a bull. After about 18 months of being a bear, I became a bull. When SPX was about 1120 i.e. way before the crash that I had been waiting for, for so long (e.g. see

http://cdn-trader.blogspot.com/2008/06/end-is-nigh.html). Ironic? Yes. Annoying? Slightly. But, in fact, it has not been so bad. My account has performed well regardless (up another 17% this week). And the reality is that, just as there is no bell rung at the top of the market, there is no bell rung at the bottom either. The returns following shortly after the bottom of the market can be large, but, once it becomes obvious that the bottom is 'in', it is too late. One needs to take a controlled amount of risk and put some capital on the line. The key is practising good risk management. Mine has been OK, certainly better than it used to be, but far from perfect. Something to continue working on.

A quick review of trades over the past week. The HUGE rally on Monday scared me, it was too big a rally for a bull market -- it was more of a bear market rally. My initial reaction on Tuesday morning was to sell all my long positions, and I started to do that, selling my entire Japanese equities position, but then I got a case of the 'what ifs', as in, "what if the market keeps going up and I sold everything" -- regret, greed, etc -- and sold half of everything else. Of course, in retrospect Tuesday morning was the greatest time to sell and go short, and it almost appears obvious, but it was not at the time.

I debated re-entering the long positions Wednesday and again early Thursday, but it was not until late Thursday, when I saw the successful 'test' of last Friday's lows with a strong rally following, that I re-entered most positions (did not do Japan, though).

I am not an experienced chartist and do not know the names of patterns, but what we saw this week must constitute a pretty bullish pattern. A massive crash on Wednesday (one of the largest in history) followed by early move lower Thursday, subsequent rally, and a small loss Friday.

I think we are setting up for a nice rally over the next few weeks. Sentiment is pretty negative. Last week was really scary, and I bet that a lot of people who still had some money and 'cajones' jumped into the market on Monday / early Tuesday, and were then burned on Wednesday / Thursday. Those people were reminded that bottom-calling is not easy. A lot of people were probably thinking of buying and have since drawn back. They are in 'wait and see' mode. A a lot of people are expecting the market to resume its downward slide next week, but it has now been 5 sessions since the most recent bottom. The slide is probably over for now.

Some other supporting factors: VIX was over 70! for several days. EUR/JPY has been at panic levels but has not made new lows. Also, the 2-year note yield has not hit new lows, suggesting that the fixed income market is not expecting more interest rate cuts. In fact, the longer end of the yield curve was hit, causing the yield curve to steepen considerably. A lot of people have suggested that this is because the market is worried about the large amount of supply from all the extra debt that the US Treasury is going to have to issue. But I think the real reason is that the market is starting to discount a normalisation of economic conditions. A steep yield curve will also help the banks strengthen their balance sheets. The policy response from governments around the world has been overwhelming the past week, and it appears that they finally "get it". They will do whatever it takes to protect the financial system. Finally, there are tentative signs that the money markets are starting to work again. In fact, we could see LIBOR decline very quickly in the near future as people realise that the global financial system is NOT going to implode, and the interbank markets re-start.

One of my best positions, however, is my short gold equities position, which is up about 50%, and constitutes a significant chunk of my portfolio (over 25%). I still love this position. Gold has fallen back to near its most recent low, and I think it will collapse over the near future as people realise that the crisis is over and inflation is not coming back for a while. Even with the recent panic buying (and media stories about shortages of gold coins), gold never got near $1000/oz. Most other commodities have collapsed. This sucker is going down!

I am long energy equities. Oil came down to $70/b, even lower than my expectations ($80), and energy equities have collapsed. This is a short-term play -- I am looking for a sharp bounce. HEU came down from $30 to under 5$. Looking at the chart, and the fact that $75 oil is still a pretty good price, HEU at $15 is not out of the question.

On my long index positions, I think that the indices may rally for a few weeks, maybe longer. There is a strong possibility of a re-test of the recent lows in the next few months. I will have to decide at that time how to play it (whether to hold on or try to time it). But I think we could see a nice rally after that for 3-6 months. But this economy is pretty sick, and stocks are still not cheap. Eventually we will probably break the recent lows. It will be important not to get caught up in the hype. Once it becomes accepted wisdom that the market is going to be fine -- it will be time to go short again.

MARKET POSITION: EQUITIES: LONG ENERGY (1 unit); LONG S&P/TSX (1.5 units); SHORT GOLD (3 units); LONG EAFE (2 units); LONG SPX (3 units); CASH (3 units)

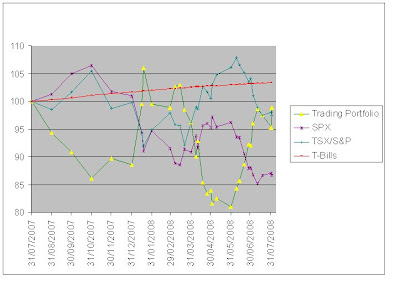

I think the charts speak for themselves. It was a great month. Despite being a bull at the start of the month, I managed to be fairly agile and catch some of the big moves from both sides. I even nailed the bottom of SPX within a few points.

I think the charts speak for themselves. It was a great month. Despite being a bull at the start of the month, I managed to be fairly agile and catch some of the big moves from both sides. I even nailed the bottom of SPX within a few points.

March was a difficult month (and so was the first part of April). There have been numerous reports of well-known hedge funds suffering big losses, but that is small solace. I made two fundamental mistakes last month: 1) not covering my short positions in the aftermath of the Bear debacle, and 2) entering into the long gold / short homebuilders trade. The first I should have known and discussed last week. The second was premature. I had been saying since Christmas that gold was overbought. I still need to work on being patient. There is no imperative to enter a trade. It is acceptable to hold cash.

March was a difficult month (and so was the first part of April). There have been numerous reports of well-known hedge funds suffering big losses, but that is small solace. I made two fundamental mistakes last month: 1) not covering my short positions in the aftermath of the Bear debacle, and 2) entering into the long gold / short homebuilders trade. The first I should have known and discussed last week. The second was premature. I had been saying since Christmas that gold was overbought. I still need to work on being patient. There is no imperative to enter a trade. It is acceptable to hold cash.